Instant Loans: A New Way To Borrow With Just A Few Taps

Those days are gone when getting a loan meant endless paperwork, frustrating waiting times, and stringent eligibility criteria. This has given rise to the era of instant personal loan, where convenience meets necessity, all within your smartphone. Let's delve deep to dissect the world of instant loans to get a comprehensive understanding of what instant personal loans are and how to borrow with just clicks and taps.

First, let's understand what an instant personal loan is in the most basic terms. Instant personal loans or a quick loan are loans that are quickly approved and disbursed with minimal documentation. New-age fintech companies allow you to apply for these loans online through mobile applications and receive immediate approval within minutes. Now, let's move on to see why these instant personal loans are getting so popular.

- Time Efficient: Unlike traditional loans, getting an instant loan is very quick, as the name says it all. With instant loans, you don't need to wait for hours in bank queues anymore.

- Less Paperwork: One of the reasons behind the speed of instant loans is the minimal documentation and paperwork. As it doesn't require a multitude of documents like traditional loans.

- Simplified Eligibility Criteria: With less paperwork, you also get simplified eligibility criteria; this makes instant loans more accessible to people who usually don't have a perfect credit score or are new to the credit system.

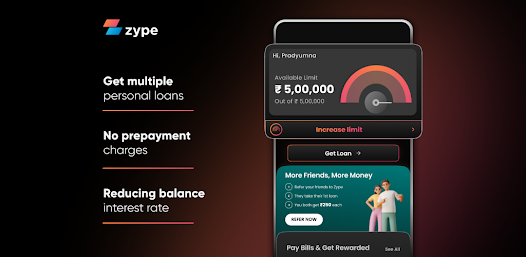

- Flexibility: Instant personal loan app also offers you better flexibility with repayment terms and loan amounts, allowing you to get a tailor-made borrowing experience best suited to your needs.

These are some of the major benefits that the quick loan app offers. With all these benefits, there are also some things that you need to be careful about when scouting for instant personal loan apps. Some of them are:

- Interest Rates: Both the speed and convenience offered by instant personal loans come at a cost, generally in the form of high interest rates. However, you might need to compare several options to get the best interest rates.

- Regulatory Issues: Given the fact that this is a relatively new financial industry, not all instant loan applications are regulated, posing a risk of fraudulent activities. So, it's better to keep your eyes out while scouting an instant personal loan app.

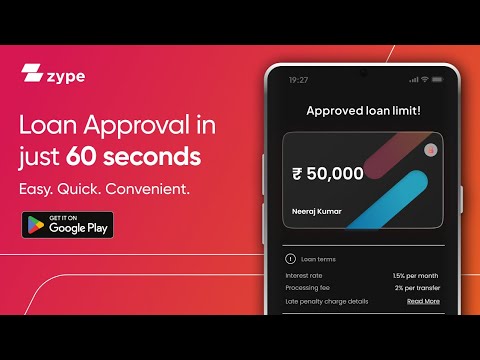

With both benefits and potential risks in mind, let's go through the process of how these instant loans work. The most popular option is to get a trusted instant personal loan app and make an application through it. Once you apply advanced AI and ML algorithms, assess your profile to run a risk and eligibility based on your application and give you results within minutes.

Once your profile is evaluated, you will be given a maximum limit of how much you can borrow based on the risk assessment of your profile. You can then choose the amount you need and the repayment term that suits your needs the best. Once approved, you will get the amount transferred directly to your bank account. The repayment process is also very simple, with a variety of repayment options, including direct debit.

The world of quick finance and online loan app represents the future, allowing you to borrow money quickly. While the landscape of instant loans continues to evolve, the blend of technology and finance holds promising potential for redefining the way we borrow money.