Obtaining a business loan is often an essential step for companies to fuel growth, expand operations, or navigate through challenging times. However, managing the equated monthly installment (EMI) efficiently is necessary to ensure financial stability and avoid unnecessary strain on your business finances.

Here are several proven strategies that can help maintain a low EMI on your business loan:

- Assess Loan Amount Carefully

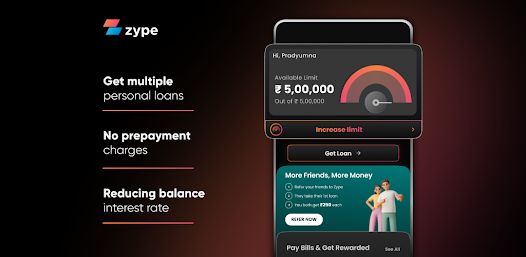

Before availing a business loan through any instant personal loan app, conduct a thorough assessment of your financial needs. Borrow only what your business truly requires, avoiding overborrowing that might result in higher EMIs. A realistic evaluation of your funding necessities ensures you’re not burdened with an EMI that strains your cash flow.

- Negotiate Interest Rates

Negotiating the interest rate can play a crucial role in lowering your EMI. Present your business’s strong financial standing, credit history, and potential for growth to negotiate for a lower interest rate. Even a slight reduction in the interest rate can substantially impact your EMI and overall loan repayment amount.

- Use Collateral or Guarantees

Offering collateral or personal guarantees can often result in more favorable online loan terms, including lower interest rates or longer repayment tenures. By providing security against the loan amount, lenders may be more inclined to offer lower EMIs as the risk associated with the loan decreases.

- Prepayment and Part-Payment Options

Exploring prepayment or part-payment options can reduce the overall interest burden and lower the EMI. Allocate surplus funds periodically towards prepayments or part-payments, effectively reducing the outstanding principal amount. Confirm with your lender about their prepayment policies and any associated charges before opting for this strategy.

- Monitor Interest Rates

Keeping an eye on market fluctuations in interest rates can be advantageous. If you’ve availed of a floating interest rate loan, consider refinancing or negotiating the terms when market rates dip. This could lead to a reduced interest rate and, subsequently, lower EMIs.

- Maintain a Good Credit Score

Maintaining a good credit history is essential for favorable loan terms. Timely repayment of existing loans and maintaining a healthy credit history significantly impact your eligibility for lower interest rates, positively affecting your EMI.

- Review Loan Terms Regularly

Periodically review your loan terms and conditions. As your business grows or your financial situation changes, reevaluate your loan agreement. In some cases, refinancing or negotiating with the lender for revised terms can help in securing a lower EMI.

- Create a Contingency Fund

Establishing a contingency fund specifically designated for loan repayments ensures that unforeseen financial challenges won’t disrupt your EMI payments. This fund acts as a buffer during economic downturns or unexpected business expenses, preventing default or late payments.

- Seek Professional Advice

Consulting financial advisors or experts through a reputable online loan app can provide valuable insights into optimizing your loan structure and repayment strategy. Their expertise can assist in devising a sustainable plan to maintain a low EMI while ensuring financial stability for your business.

In conclusion, maintaining a low EMI for your business instant loans requires meticulous planning, assessment of your financial capabilities, and exploring viable strategies. By implementing these proven strategies, businesses can effectively manage their EMIs, ensuring smoother loan repayments and fostering financial health and growth.